Related posts

See all

My workpaper had crashed a third time that day, and I'd spend another late evening at the client’s office. This was 2013, and I was a second-year Big Four auditor.

Eight years later, software used by assurance and advisory firms hasn't kept up with technology advances and practitioners continue to face daily inefficiencies. Engagements require manual copying and pasting between system and files, from set up to reporting. Client files are lost and buried in inboxes. Team members can't collaborate in real-time due to the risk of file collisions and lost changes. All of this results in poor client experiences and long practitioner hours.

Over time, these inefficiencies create downstream issues for practices. Long engagement hours mean shrinking margins and limited bandwidth to grow client bases. Exhausted of the long hours and manual work, professionals are choosing other professions and exacerbating industry-wide talent shortages.

As a former practitioner, I realized that software is the strategic lever to transform the assurance and advisory market. This conviction led me to solve technology challenges for the industry.

Assurance services, including audits and attestations, and their advisory cousins, serve an important role in capital markets and business transactions.

Practitioners power the trust necessary for capital markets and business to function properly. For example, annual reports and audited financial statements (10-Ks) provide investors with vital information that drive investment decisions. SOC 2 reports provide the essential trust when businesses do business together.

From individual investors to Fortune 500 enterprises, assurance and advisory firms enable essential transparency for markets to work. Solving the technology problem for this industry, which generates hundreds of billions in revenue annually, therefore adds widespread value to the economy and society.

Fast forward to the spring of 2020. My co-founder, Chris Szymansky, and I had honed in on our shared pains in compliance audits as the problem to tackle. As a seasoned technology leader, Chris had many compliance audits under his belt from the client-side. We felt that our combined perspective brought unique empathy to solving the audit problem.

As the world changed, we believed that the timing was perfect for new, modern software for assurance and advisory engagements. The rapid shift to remote staffing accelerated the need for digitized practitioner workflows. Firms suddenly faced more competition from the increased use of technology and diminishing geographic boundaries. Lastly, expectations for enterprise software were higher than ever. End users and clients expected best-in-class design standards and seamless remote collaboration experiences.

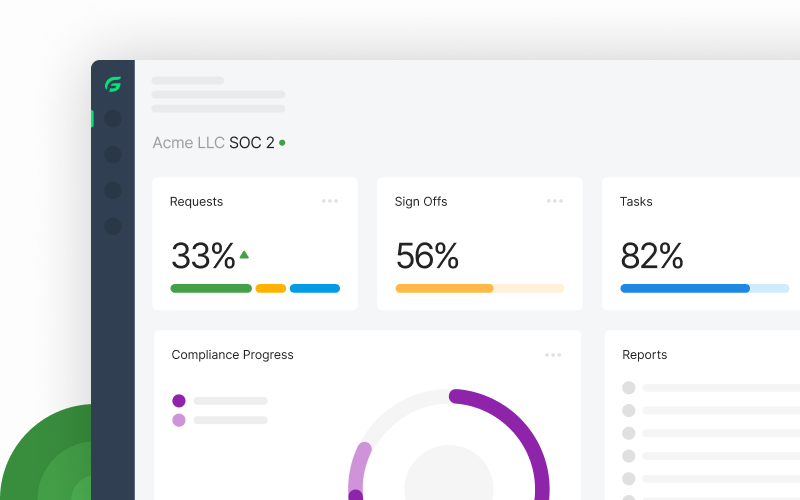

Today, we're excited to introduce Fieldguide, a complete automation and collaboration platform for assurance and advisory firms. By digitizing and centralizing the end-to-end engagement workflow, Fieldguide enables top CPA firms to improve efficiency and collaborate in real-time – and ultimately increase margins, win new business, and build stronger client relationships.

Fieldguide’s cloud-native platform augments practitioner expertise with a workflow automation engine that works flexibly across transparency standards, such as cyber and information security standards like SOC 2, NIST CSF, and ISO 27001, in addition to regulatory standards like SOX404 and PCI DSS.

With Fieldguide, practices can:

1. Automate any workflow: Fieldguide improves productivity and eliminates errors by automating every step of the engagement, from requests to reporting. Our flexible templates and customizable workflows can adapt to the needs of any standard or framework.

"Fieldguide opened possibilities to get things done more efficiently, so my team can do what they do for more clients."

2. Collaborate in one source of truth: Fieldguide brings together your entire engagement on a single, cloud-native platform. Track progress across projects at a glance, and collaborate in real-time with your team and clients without downloading a single file.

"With Fieldguide, all information is located in one place, providing a single point of truth for the engagement. Information is consistent every step of the way."

3. Enhance the client experience: Fieldguide helps you gain a competitive advantage and win new business. Clients love the modern, intuitive experience and seamless collaboration.

“Fieldguide is dramatically enhancing the client experience with their flexible approach and intuitive workflows. Our team and clients are excited by the platform’s capabilities and value.”

Fieldguide is the tool I wish I had when I was a practitioner. The platform specializes in risk engagements, but is flexibly designed to streamline a variety of services. Beyond risk services, many of our customer firms plan to expand use of the platform to financial statement audits, employee benefit plan audits, and other agreed-upon procedures. Soon, firms will be able to leverage deeper automation capabilities powered by artificial intelligence and machine learning.

Our current customers include risk assurance and advisory practices at leading CPA firms, including several in the top 35. With Fieldguide, practices already experience 15-20% efficiency gains and 5-10% realization gains, compared to previous workflows based on legacy software.

Fieldguide’s mission is to increase trust in global commerce and capital markets by equipping the assurance and advisory industry with best-of-breed automation software. We believe that the future of trust services involves a deep, technical partnership with practitioners.

We're thankful for our investors who are early believers in our mission: 8VC, Floodgate, Y Combinator, DNX Ventures, Global Founders Capital, and many others. If you'd like to be part of this mission, we're hiring!

If you're a risk practice leader, our team is committed to your success, from building a business case to providing ongoing support. Join the Fieldguide movement and request your demo today.